尊敬的用户您好,这是来自FT中文网的温馨提示:如您对更多FT中文网的内容感兴趣,请在苹果应用商店或谷歌应用市场搜索“FT中文网”,下载FT中文网的官方应用。

The US economy has done far better over the past few years than many would have expected, particularly given the multiple headwinds from the pandemic, US-China decoupling, the war in Ukraine and general political chaos in Washington.

过去几年,美国经济的表现远远好于许多人的预期,特别是考虑到疫情、中美脱钩、乌克兰战争和华盛顿普遍的政治混乱等多重不利因素。

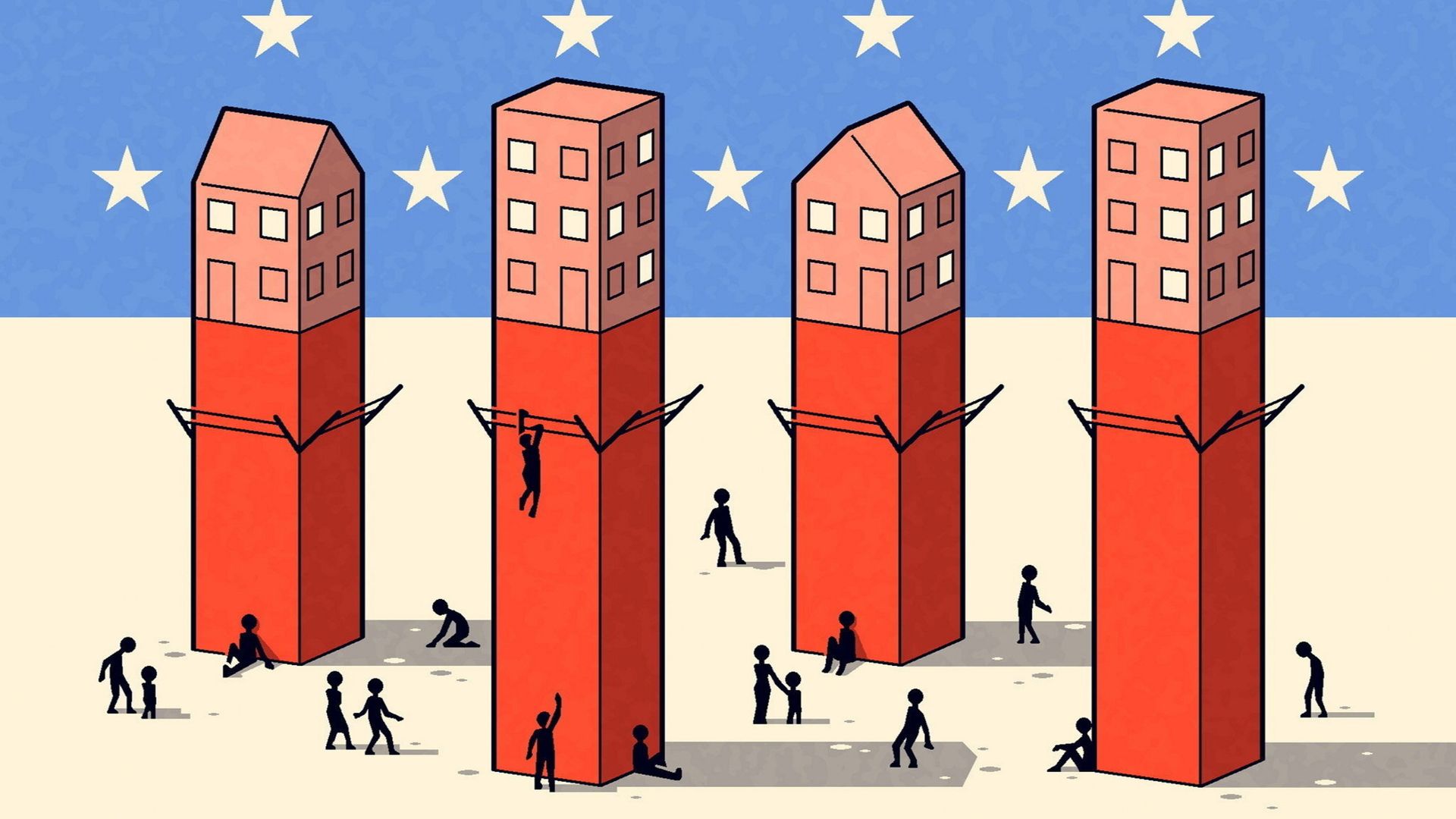

The country has enjoyed an almost immaculate economic cooling, along with a still-robust jobs market and good overall gross domestic product growth. Particularly when compared with other countries, the US economy looks as good as it could be right now. However, there is one conspicuous fly in the ointment — housing.

美国经济几乎没有出现明显降温,就业市场依然强劲,国内生产总值(GDP)总体增长良好。特别是与其他国家相比,美国经济目前看起来好得不能再好了。然而,有一个问题十分突出,就是住房问题。

You can see it in last week’s consumer price index numbers, which showed inflation to be a bit higher than was forecast. The main culprit, aside from ever-volatile food and oil prices, was housing. The shelter index portion of the CPI was up 7.2 per cent over the past year, accounting for more than 70 per cent of the total increase in all items, aside from food and fuel.

从上周的消费者价格指数(CPI)数据中你就可以看到这一点,该数据显示,通胀率略高于预期。除了不断波动的食品和石油价格外,罪魁祸首是房地产。过去一年,消费者价格指数中的住房指数部分上涨7.2%,占除食品和燃料外所有项目总涨幅的70%以上。

The inflation numbers raise the prospect of another Federal Reserve interest rate increase in the future, at a time when Wall Street was betting that hikes were over.

通胀数据提高了美联储(Fed)未来再次加息的可能性,而此时华尔街正押注加息结束。

But would that be the best policy solution for the housing problem in the US? There’s a strong argument to be made that the answer is no. For some time now, the core inflation story in America has been all about housing. Unlike other markets, including the UK, where prices have dropped 13.4 per cent in real terms from their March 2022 peak, the American housing market is not cooling, despite multiple interest rate hikes.

但这是解决美国住房问题的最佳政策方案吗?有一个强有力的论据可以证明答案是否定的。一段时间以来,美国的核心通胀都与房地产有关。与包括英国在内的其他市场不同,尽管美国多次加息,美国房地产市场却并未降温,而英国房价已从2022年3月的峰值实际下跌13.4%。

Indeed, you can argue that rate rises have made things worse in housing markets. How is this to be explained? Start with the fundamental problem, which is too little housing supply relative to demand in the US. The country’s housing production hasn’t kept pace with household formation since the Great Financial Crisis of 2008, when the number of housing unit starts dropped off a cliff. Since then, demand has far outpaced supply, leaving the US millions of units short of what its population needs.

事实上,可以说,加息使房地产市场的情况变得更糟了。这该如何解释呢?先从根本问题说起,即美国的住房供应相对于需求太少。自2008年金融危机爆发以来,美国的住房产量急剧下降,一直跟不上家庭组建的速度。自那以后,需求远远超过供应,从而导致美国住房供不应求。

Part of this is about nimbyism, meaning the “not in my backyard” approach to housing policy at a local level. While plenty of Americans in big cities such as New York, Los Angeles or San Francisco would agree that there’s a need for more affordable housing, and indeed more housing in general, few prosperous homeowners (or even renters) would vote to locate such a project near them.

部分原因是“邻避主义”(nimbyism),即在地方层面采取“不要在我家后院”的住房政策。虽然纽约、洛杉矶或旧金山等大城市的许多美国人都赞同需要更多的经济适用房,总体上也确实需要更多住房,但很少有富裕的房主(甚至租房者)会投票赞成在他们附近建这样一个项目。

Studies have found that city politics around zoning tends to favour the opponents of plans rather than the developers. This is a key reason that housing remains constrained.

研究发现,围绕分区规划的城市政治倾向于支持计划的反对者,而不是开发商。这是房地产市场依然受限的一个关键原因。

This problem is being further fuelled by an influx of migrants to sanctuary cities in the US, where shelter is in theory guaranteed but in practice is not available. There are also lingering issues with inflation on materials and labour since the pandemic. These have either deterred new home construction or simply made it unaffordable.

大量移民涌入美国的庇护城市,进一步加剧了这一问题。在美国,庇护在理论上是有保障的,但实际上是没有的。自疫情以来,材料和劳动力通胀问题也挥之不去。这些问题要么阻碍了新住宅的建设,要么干脆让人们负担不起。

Housing is, in many ways, America’s last remaining supply chain problem. Fuel prices are up, as well, though that issue will eventually be resolved as US wells pump more and Opec adjusts supply. But the problem of housing inflation, which has been unwittingly exacerbated by the Fed, won’t go away any time soon. The home price/mortgage rate arbitrage is working against homeowner mobility.

在很多方面,住房是美国最后遗留下来的供应链问题。燃料价格也在上涨,不过随着美国油井增加产量以及欧佩克(Opec)调整供应,这一问题最终将得到解决。但美联储无意中加剧的住房通胀问题不会很快消失。房价/抵押贷款利率套利正在阻碍房主的流动性。

The current 30-year fixed mortgage rate in the US is around 8 per cent. That’s up from under 3 per cent in 2021. Meanwhile, the median house price is up 29 per cent, from $322,000 in 2020 to $416,000 today. Add to this the fact that many homeowners locked in very, very low rates over the past few years. Unless you are about to see your rate reset, it’s extremely hard to justify moving.

美国目前30年期固定抵押贷款利率约为8%,而在2021年,这一数字还不到3%。与此同时,房价中位数上涨了29%,从2020年的32.2万美元升至如今的41.6万美元。除此之外,许多房主在过去几年里锁定了非常非常低的利率。除非你的利率即将重置,否则很难证明搬家是合理的。

My husband and I, for example, have a variable rate of 2.875 per cent that won’t be reset till 2031. With my second child about to leave for college next year, I would love to downsize from the family home and move in to something smaller. But the combination of a still frothy housing market, coupled with high mortgage rates and the overall tax burden associated with home sales in places such as New York, means that it doesn’t make financial sense for us to leave — we would pay more for much less.

例如,我丈夫和我拥有的浮动利率为2.875%,直到2031年才会重置。我的第二个孩子明年就要上大学了,我想从家里搬到小一点的地方住。但是,房地产市场仍然存在泡沫,加上抵押贷款利率高企,再加上纽约等地与房屋销售相关的总体税收负担,这意味着我们离开这里在财务上没有意义——我们会为更少的东西付出更多的钱。

This is the dynamic that is keeping prices high, even in the face of higher rates. And it’s a recipe for continued inflation, particularly if rates continue to rise.

这就是房价居高不下的动力,即使面对更高的利率也是如此。这也是导致持续通胀的原因,尤其是如果利率继续上升的话。

Some economists are now calling on the Fed to rethink its traditional approach based on this confluence of factors. “I have moved from scratching my head, to being annoyed, to frankly being livid at central banker devotion to cyclical models that simply don’t apply to the post-pandemic era,” says Dan Alpert, managing partner of Westwood Capital. Alpert is a professor at Cornell Law School who has long advocated that the Fed should think more creatively about housing market inflation when considering new rate rises.

一些经济学家现在呼吁美联储根据这些因素重新考虑其传统的做法。韦斯特伍德资本(Westwood Capital)管理合伙人丹•阿尔珀特(Dan Alpert)表示:“我已经从摸不清头脑,变成恼火,坦率地说,我对央行行长对周期模型的执着感到愤怒,这些模型根本不适用于疫情后时代。”阿尔珀特是康奈尔大学法学院(Cornell Law School)的教授,他长期以来一直主张美联储在考虑新的加息措施时,应该更有创造性地考虑房地产市场的通胀问题。

If the current paradigm of high prices, high rates and insufficient supply continues, something will have to give. We may not see a major housing market correction in the US soon, given how many people are locked into low rates, but unless a lot more homes are built in the next few years, it will be very difficult to manage America’s housing affordability crisis.

如果目前这种高价格、高利率和供应不足的模式继续下去,有些东西就必须做出一些让步。鉴于有很多人被低利率所困,我们可能不会很快看到美国房地产市场出现重大调整,但除非在未来几年建造更多的房屋,否则将很难应对美国的住房负担能力危机。