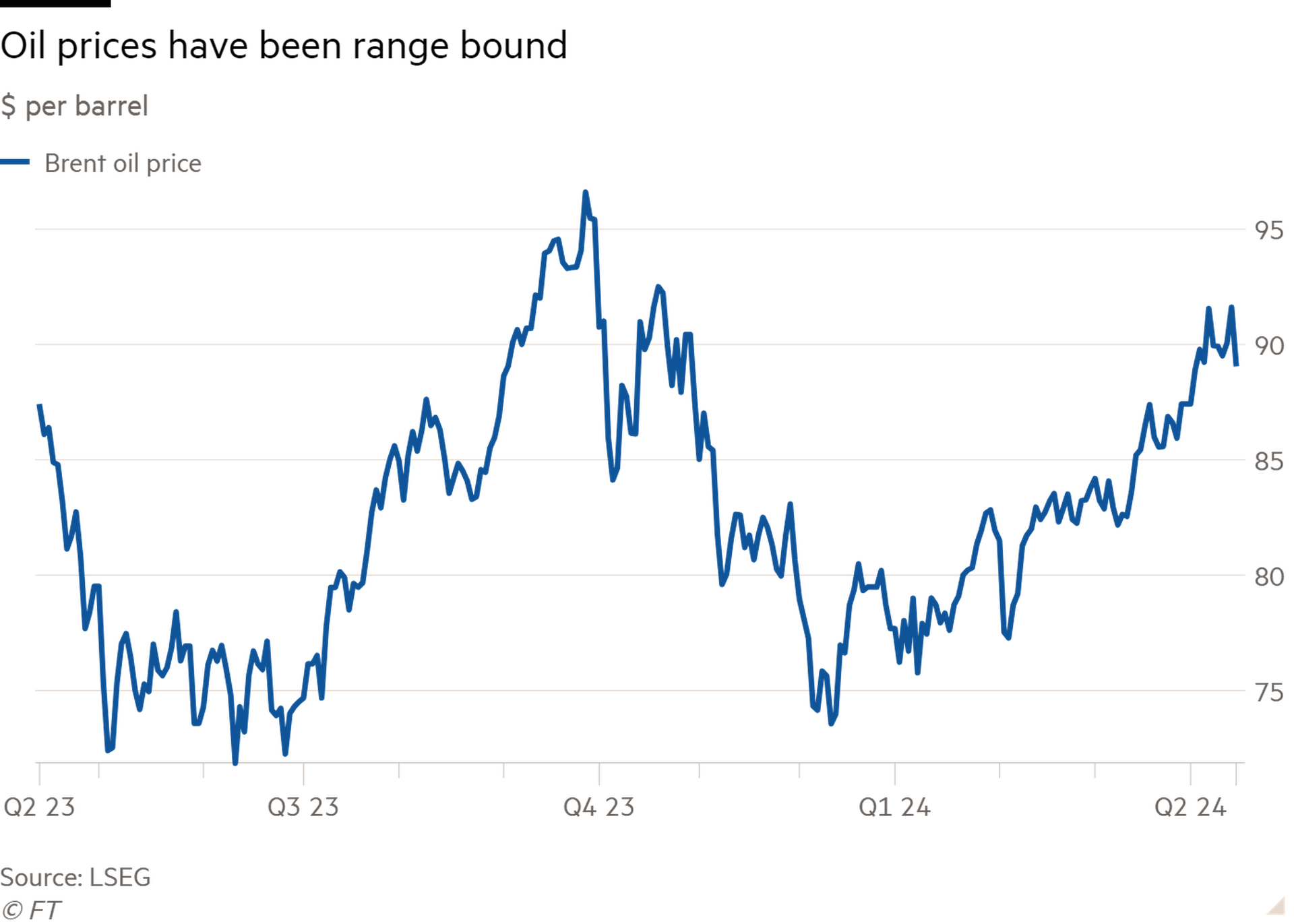

Despite crude oil’s combustible properties, armed conflict near large oil producers — Russia and now Iran — has not ignited a sustained rise in price. Brent crude fell on Monday, struggling to stay above $90 a barrel, after this weekend’s attack on Israel by Iran.

Why is the oil market so relaxed in the face of escalating regional tensions? The oil price may increasingly self-regulate in price terms. Higher oil prices just stoke fears of a reacceleration of broader price inflation. This would remove one of the factors behind the recent rally in equity prices. It is unlikely that commodity prices would continue to climb should central banks start to play down the prospect of interest rate cuts.

World stock prices have rallied a fifth since October, anticipating an inflection point for interest rates. That hope has already dimmed. US Federal Reserve chair Jay Powell this month hinted that the central bank would move slowly. US bond yields, anticipating problems, have risen this year. Interest rate traders anticipate less than half as many reductions by global central banks as at the beginning of the year.

As a result, equity markets are already more jittery — not a positive for oil. Since 2000 oil prices have rarely continued rising when the S&P 500 has a sustained decline. That surely would happen if oil prices soared in an all-out war between Iran and Israel. Opec+ producers could also use their almost 6mn barrels per day of spare capacity were price rises seen to threaten central banks’ next move, thinks Rystad Energy.

Traders may also be questioning the extent of Iran’s military threat. The country will not want to hurt its own oil exports. These have picked up markedly in recent years, from a low of about 400,000 b/d in the pandemic year of 2020 to about 1.4mn b/d recently, according to Richard Bronze at Energy Aspects. Almost all of that is tanked to China from the Gulf through the Strait of Hormuz.

China brokered last March’s restoration of diplomatic relations between Iran and Saudi Arabia after a seven-year dispute. Iran’s largest customer will not want to see that undone, nor does Iran wish to threaten its export revenues. Its recent failed attempt to raise the cost of its discounted oil to its Chinese customers underscores a poor negotiating position.

Yes, oil prices could well rise if further hostilities ensue. But as politicians rush to avoid further conflict, markets are already signalling their fears that central banks will keep rates higher for longer. That should help keep oil range bound in the months ahead.